Delav Capital

International Investments

Somos un grupo Chileno–Paraguayo que conecta capital extranjero con desarrollos inmobiliarios de alto retorno en Paraguay. Combinamos desarrollo de proyectos, brokeraje global, fondos de inversión y alianzas estratégicas para transformar inversiones en comunidades de calidad y rendimientos seguros.

Historia

Delav Capital está liderada por el Ingeniero Comercial Joaquín Ignacio de la Vega J., un empresario con más de 12 años de experiencia en negocios en Chile, Paraguay y Estados Unidos. A lo largo de su trayectoria, Joaquín ha acumulado un profundo conocimiento en desarrollos inmobiliarios y comercio internacional de marcas electrónicas, logrando identificar oportunidades emergentes en mercados clave.

En 2020, decidió apostar por Paraguay, reconociendo su enorme potencial en términos de desarrollo inmobiliario y beneficios fiscales. Esta visión le permitió crear Delav Capital, un vehículo de inversión y consultoría que ayuda a inversionistas extranjeros a maximizar sus rendimientos y a establecerse en un entorno fiscalmente favorable. Hoy, Delav Capital se posiciona como una empresa sólida, enfocada en crear valor a través de proyectos inmobiliarios de alto impacto.

Misión

En Delav Capital, nuestra misión es transformar las oportunidades que ofrece Paraguay en éxitos tangibles para nuestros clientes. Nos especializamos en ofrecer soluciones integrales en desarrollos inmobiliarios, consultoría estratégica y vehículos de inversión, asegurando seguridad, crecimiento y rentabilidad a largo plazo.

Visión

Ser el mayor desarrollador de viviendas en Paraguay, posicionándonos como el vehículo de entrada preferido por inversionistas extranjeros y nómadas digitales que buscan un entorno seguro, rentable y fiscalmente favorable para sus negocios.

Valores

Excelencia

Nos comprometemos a alcanzar los más altos estándares en cada proyecto que emprendemos, asegurando calidad y profesionalismo.

Transparencia

Creemos en la importancia de una comunicación clara y honesta con nuestros clientes, generando confianza y relaciones a largo plazo

Innovación

Adaptamos nuestras estrategias a las tendencias globales y locales, para ofrecer soluciones creativas que aporten valor a nuestros inversionistas.

Responsabilidad

Entendemos que nuestros proyectos tienen un impacto en la comunidad y en el medio ambiente, por lo que actuamos de manera consciente y ética en cada uno de nuestros desarrollos.

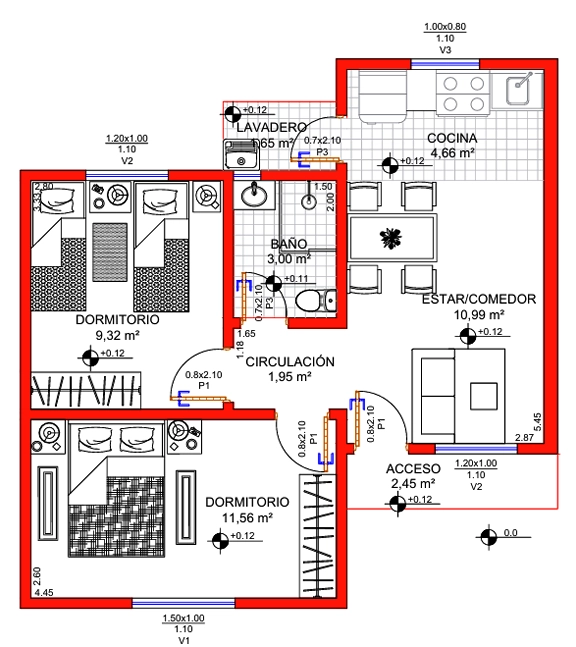

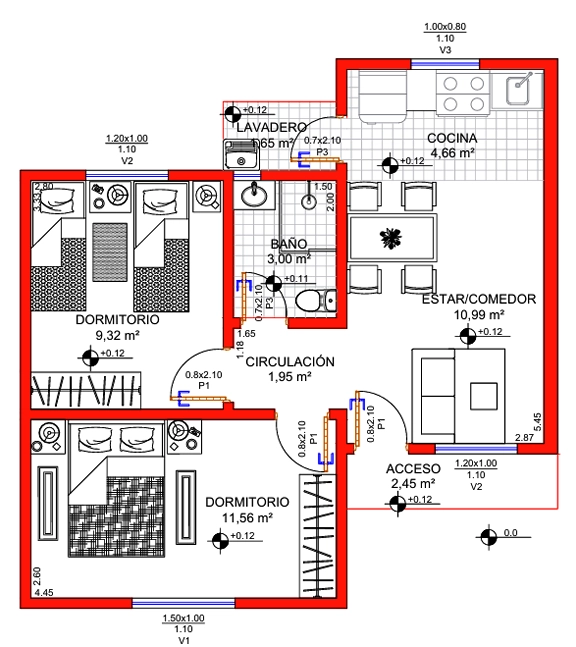

Desarrollos Inmobiliarios

En Delav Capital, nos enfocamos en adquirir, subdividir y desarrollar proyectos inmobiliarios en Paraguay, un mercado en auge. Nuestra experiencia y conocimiento local nos permiten ofrecer a nuestros inversionistas altas rentabilidades con un riesgo controlado. Facilitamos el proceso desde la compra del terreno hasta la construcción y venta de los inmuebles.

Vehículo de Inversión

Ofrecemos la oportunidad de invertir en desarrollos inmobiliarios en Paraguay, asegurando rentabilidades anuales por encima del 14% en dólares. Nuestro vehículo de inversión está diseñado para inversionistas que buscan apalancarse en la experiencia y el éxito de Delav Capital en el mercado paraguayo

Residencia Fiscal

Aprovecha las Leyes Fiscales Exclusivas de Paraguay para Proteger Tu Patrimonio, Maximizar Tu Rentabilidad y Posicionarte Como Pionero en un Mercado Emergente.

0% de impuestos extraterritoriales

Comercio Internacional de Marcas de Electrónica

Como representantes exclusivos de Miccell para Brasil, lideramos la distribución de productos electrónicos de alta gama. Ofrecemos un servicio completo de comercio internacional, conectando a nuestros clientes con oportunidades en mercados emergentes.

Consultorías

Brindamos consultoría integral para empresas y emprendedores que desean establecerse en Paraguay. Desde asesoría en desarrollos inmobiliarios, hasta estrategias fiscales, ayudamos a nuestros clientes a optimizar sus inversiones y a aprovechar los beneficios fiscales únicos que ofrece el país.

Asociados

Prime Capital Chile

Un vehículo financiero liderado por el Ingeniero Comercial Germán Oelckers, especializado en atraer capitales y financiar proyectos inmobiliarios de gran escala en Paraguay.

Prime Capital se ha convertido en un socio clave para facilitar el crecimiento de inversiones internacionales en el país.

Sketch Buildings

La agencia de marketing más destacada de LATAM, liderada por James Smith, especialista en embudos de venta y marketing digital.

Sketch Buildings es nuestro socio estratégico para potenciar la visibilidad y el crecimiento de nuestros proyectos en mercados internacionales.

Miccell

Marca internacional de electrónica, con la cual Delav Capital tiene la exclusividad de distribución para Brasil.

Nuestra alianza con Miccell nos permite liderar el comercio internacional de productos electrónicos de alta calidad, posicionándonos como una referencia en el sector.

Cima Desarrollos y Petrohue Real Estate

Nuestros colaboradores estratégicos en Paraguay, que comparten nuestra visión de desarrollo y expansión sostenible. Juntos, hemos emprendido proyectos inmobiliarios de alto impacto, generando valor en el sector.

Trusted by 2000+ businesses

Our featured exclusives

- Todo

- A la venta

What we are providing

Property Management

We provide a range of services to property owners and landlords to help them effectively manage their real estate investments.

Home Buying

Planning to buy home? We offer a range of assistance to make the home buying process smoother and more convenient for the buyer.

Consulting Service

A team of professionals to advice and expertise to individuals, businesses, or organizations involved in various aspects of the real estate industry.

Mortgage Service

We offer a range of financial and administrative activities involved in obtaining a mortgage loan to purchase or refinance real estate.

Home Selling

Whether you are an individual homeowner, real estate investor, we assist in marketing, selling, and closing the sale of your property.

Escrow Service

We are serving as a neutral third party that facilitates the closing process and ensures that the terms and conditions of the sale are met.

Explore New Neighbour-hood

Great Place to relax, have a picnic or enjoy nature. You might discover unique stores, artisanal products along with local food.

Our Agents

Real Estate Agent

- 35 Sale

- 60 Rent

- Operating Since 2010

- 8700+ Buyers Served

- 35 Verified Properties

Real Estate Agent

- 27 Sale

- 41 Rent

- Operating Since 2014

- 6308+ Buyers Served

- 23 Verified Properties

Real Estate Agent

- 32 Sale

- 43 Rent

- Operating Since 2013

- 4212+ Buyers Served

- 39 Verified Properties

Real Estate Agent

- 44 Sale

- 53 Rent

- Operating Since 2017

- 3500+ Buyers Served

- 22 Verified Properties

David Johnson

FairfieldSuper easy & clear to follow

I have been a web designer for over 18 years now. The theme is fantastic, flexible and simply excellent to use. I cannot recommend enough!

Jane Doe

AustinSimplified property management

Thanks to the RealHomes theme, my website has become a powerful marketing tool that attracts and engages potential clients.

John Smith

Pembroke PinesKnowledge of local market

Working with John Smith was an absolute pleasure throughout the home-buying process. Their knowledge of the local market was outstanding.

Emily Wilson

OrangeConfident and comfortable

As first-time homebuyers, we were nervous and uncertain about the entire process. Emily Wilson made us feel comfortable and confident from day one.

Elissa White

AlphaNegotiation skills were top-notch

Their negotiation skills were top-notch, resulting in a sale price that exceeded our expectations. Elissa White is a true professional, and we wholeheartedly endorse their services.

What’s in Trending

Estás buscando la casa de tus sueños?

Podemos hacer realidad tu sueño de una nueva casa

Todos los derechos reservados 2023